Pension Like Income

What is an annuity?

As clients approach retirement age, many questions and concerns can arise. Often, one of clients’ biggest concerns center around retirement income. Post retirement income is often considerably less than during the working years. Whether or not it is sufficient depends on many factors, such as investment returns, inflation, health issues, and the client’s spending habits in retirement.

Annuities provide insurance against the risk of outliving your money after you stop working. You get the potential to grow your savings and create guaranteed income for life so you can retire your way. It’s no longer enough to simply save as much as you can for retirement. To help sustain the retirement lifestyle you want, you also need an income strategy, one designed to help with the income risks you will face in retirement.

While they seem to function like an investment (that is, you put your money in and accept the risk of whether it increases or decreases), many are actually insurance contracts. In general, if you follow the rules of the contract, you receive certain guarantees in return. This can alleviate some of the anxiety clients may feel about the unknown and can give them a sense of control over their retirement income planning.

Your retirement portfolio may include stocks, bonds and mutual funds that all play a part in helping you achieve a successful retirement. However, you may want to consider adding an annuity, which can complement your portfolio by providing attributes for retirement that those categories do not offer.

What can an annuity do for you?

Tax-Deferred Growth

Annuities help you increase savings because you won't pay taxes on growth until you withdraw money.

Growth Potential & Risk Management

An annuity has the potential to grow your money while also helping manage risk of loss.

You want to leave a legacy

With an annuity, you can provide your loved ones with a death benefit in the event of your death.

When you might need an annuity

If you're in one or more of these situations, an annuity might be exactly what you need.

You're saving for retirement

If you're already contributing the maximum to other retirement plans, like an IRA or 401(k), an annuity is an attractive retirement planning option that grows tax-deferred.

You won't need the money soon

If you don't anticipate needing money from savings prior to turning 59 ½, then an annuity may be a good option for you.

Replacing your paycheck in retirement

Annuities with Income Riders can provide protected income every month for as long as you live, even if that amount exceeds what you initially invested.

Different types of annuities

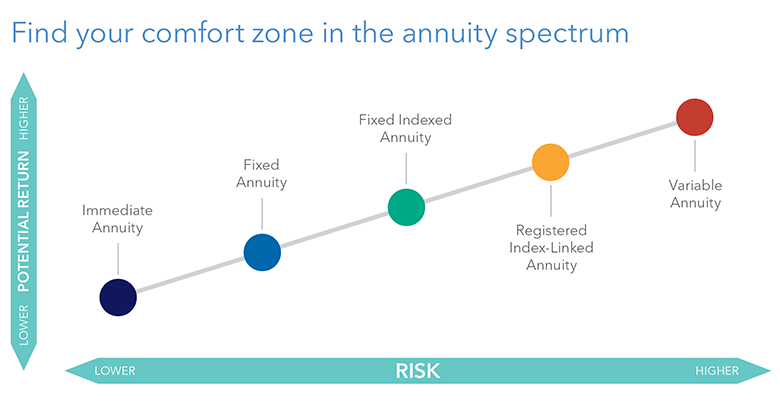

Annuities come in different types to meet different needs. One of the ways they vary is by the amount of potential risk and return.

Immediate annuities have less risk and lower return because they simply convert an amount of money into a guaranteed stream of income.

The annuities with increasing risk and return are generally used to accumulate money over time. Because they don’t provide immediate income, they’re known as deferred annuities.

Annuities aren’t right for everyone. They can be a valuable part of a diversified portfolio, especially if you want to lock in protected lifetime income to help cover your essential monthly necessities.

Fixed Annuities

Protect and grow your savings. Plan with confidence.

Fixed annuities provide you with tax-deferred growth at a fixed rate of interest set by an insurance company for a period of time specified in the annuity contract. A fixed annuity are often compared to a bank Certificate of Deposit. They also offer the opportunity to produce a guaranteed stream of retirement income you cannot outlive.

Fixed annuities are long-term investment vehicles designed for retirement purposes. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply

Fixed Indexed Annuities (FIAs)

Pursue growth potential without sacrificing security.

With fixed indexed annuities, the interest rate on a portion of your premium is tied, in part, to a published stock market index, giving you the opportunity to benefit from market trends without owning stocks. Your principal is protected from loss due to market downturns. Fixed indexed annuities may also include or offer optional riders that can be purchased or automatically attached to the annuity for a charge. Rider features vary by product, and can offer benefits like lifetime income, increased liquidity, or a death benefit option.

Fixed Indexed Annuities (FIA) are not suitable for all investors. FIAs permit investors to participate in only a stated percentage of an increase in an index (participation rate) and may impose a maximum annual account value percentage increase. FIAs typically do not allow for participation in dividends accumulated on the securities represented by the index. Annuities are long-term, tax-deferred investment vehicles designed for retirement purposes. Withdrawals prior to 59 ½ may result in an IRS penalty, and surrender charges may apply. Guarantees are based on the claims-paying ability of the issuing insurance company.

Riders are additional guarantee options that are available to an annuity or life insurance contract holder. While some riders are part of an existing contract, many others may carry additional fees, charges and restrictions, and the policy holder should review their contract carefully before purchasing. Guarantees are based on the claims paying ability of the issuing insurance company.

Variable Annuities (VAs)

Pursue growth potential with multiple choices and riders.

A variable annuity is a financial product that combines the features of an annuity and a mutual fund. It is a type of contract between an individual and an insurance company that offers the opportunity to invest money in a variety of investment options, such as stocks, bonds, and money market funds.

The value of a variable annuity can fluctuate based on the performance of the investment options that the annuity holder has selected. This means that the amount of money that an individual will receive as payments from the annuity may vary, depending on the performance of the underlying investments.

One of the key features of a variable annuity is the ability to defer taxes on the investment gains until the annuity payments are received. This can be advantageous for individuals who are in a high tax bracket during their working years but expect to be in a lower tax bracket during retirement.

Variable annuities also often offer a death benefit that guarantees that the annuity holder's beneficiary will receive a specified minimum payment if the annuity holder passes away before receiving payments equal to the full value of the annuity. However, variable annuities may also come with fees and charges that can be complex and may erode the returns on the investment. It is important to carefully consider the features and costs of a variable annuity before investing.

Variable annuities are long term, tax-deferred investment vehicles designed for retirement purposes and contain both an investment and insurance component. They have fees and charges, including mortality and expense risk charges, administrative fees, and contract fees. They are sold only by prospectus. Guarantees are based on the claims paying ability of the issuer. Withdrawals made prior to age 59 ½ are subject to 10% IRS penalty tax and surrender charges may apply. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. The investment returns and principal value of the available sub-account portfolios will fluctuate so that the value of an investor’s unit, when redeemed, may be worth more or less than their original value.

Variable Annuities with Income Riders

Pursue growth potential with guaranteed income.

An income rider on a variable annuity is an optional feature that can provide a guaranteed stream of income for the annuity holder, regardless of the performance of the underlying investments. It is essentially an additional benefit that can be added to the variable annuity contract, often for an additional cost.

The income rider typically guarantees a minimum payout amount, regardless of how the investments perform. For example, if the underlying investments do not perform well, the annuity holder can still receive a guaranteed level of income, as specified in the rider. The amount of the guaranteed income can vary depending on the terms of the rider and the annuity contract.

An income rider can provide added security for individuals who are concerned about outliving their retirement savings, as it can provide a predictable stream of income for life. However, it is important to carefully consider the terms of the rider and the costs associated with it, as these can vary depending on the insurance company and the specific rider. It is also important to understand that adding an income rider to a variable annuity will likely come with additional fees, which can reduce the overall returns on the investment.

Riders are additional guarantee options that are available to an annuity or life insurance contract holder. While some riders are part of an existing contract, many others may carry additional fees, charges and restrictions, and the policy holder should review their contract carefully before purchasing. Guarantees are based on the claims paying ability of the issuing insurance company.

Registered Index-Linked Annuities (RILAs)

Pursue growth opportunities while enjoying a level of protection from market risk.

Registered index-linked annuities provide exposure to a published stock market index along with a level of protection from market loss. While this kind of annuity tracks the movement of an index, it does not directly invest in any stock or equity vehicle. Because you assume some of the risk of loss from market downturns, a registered index-linked annuity may allow for greater growth potential than other annuities.

Immediate Annuities

Income you can count on.

Immediate annuities make retirement planning easier because they’re predictable. In exchange for a lump sum of money, an immediate annuity pays a guaranteed amount for a specified time period, including as long as you or your spouse live.